Startup Capital Migration: From Silicon to Sunshine

Carta published their 2023 State of Private Markets, and it's fascinating to see the trends by company stage and region...

📉 Valley of the Shadow of Deals...

Nearly 20% of rounds were down rounds in 2023.

Venture deal count decreased by 24% year-over-year, with cash raised by startups falling by 50%.

🌱 Seedless in Seattle...

Year over year, seed deal count is down 27%.

At seed, the median valuation inched up again in Q4 and is now 40% higher than it was nearly three years ago.

Startups closed just 462 seed investments in Q4, the smallest total since Q1 2018.

🎢 Mid-Journey Jitters

Series B deal count was down 25% in Q4, and capital raised fell 33%. At Series C, deal count declined by 33% and cash raised by 52%.

In Q4 2023, the median pre-money valuation increased by 71% at Series D and by 46% at Series E+ over Q3 medians.

☀️ Capital Migration: From Silicon to Sunshine

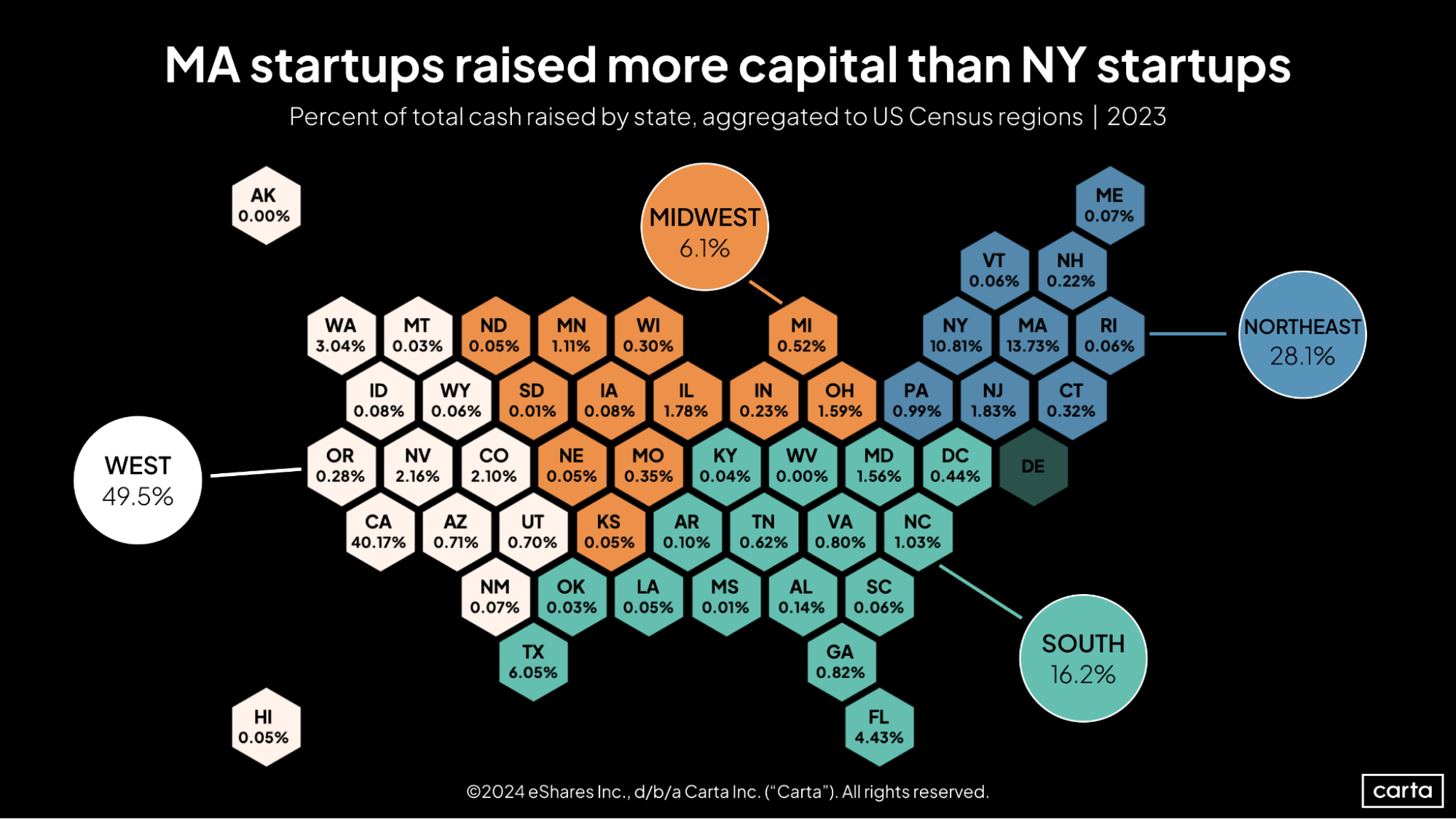

The Bay still reigns, but the trend line continues to show a decrease as Texas’s (6.05%), Florida (4.43%), Ohio, New Jersey, and Nevada saw their share of startup fundraising climb significantly in 2023.

The geographical distribution of funding saw Massachusetts surpassing New York in total capital raised, with Texas and Florida also seeing significant gains.

🏈 Southern Comfort/Discomfort

Good: Startups in the South raised 16.2% of all capital in the U.S. over the course of 2023, up from 15.5% the year prior.

Bad: Despite that annual uptick, the South’s market share has decreased for three straight quarters, dipping to 15% in Q4 2023, its lowest quarterly mark in two years.